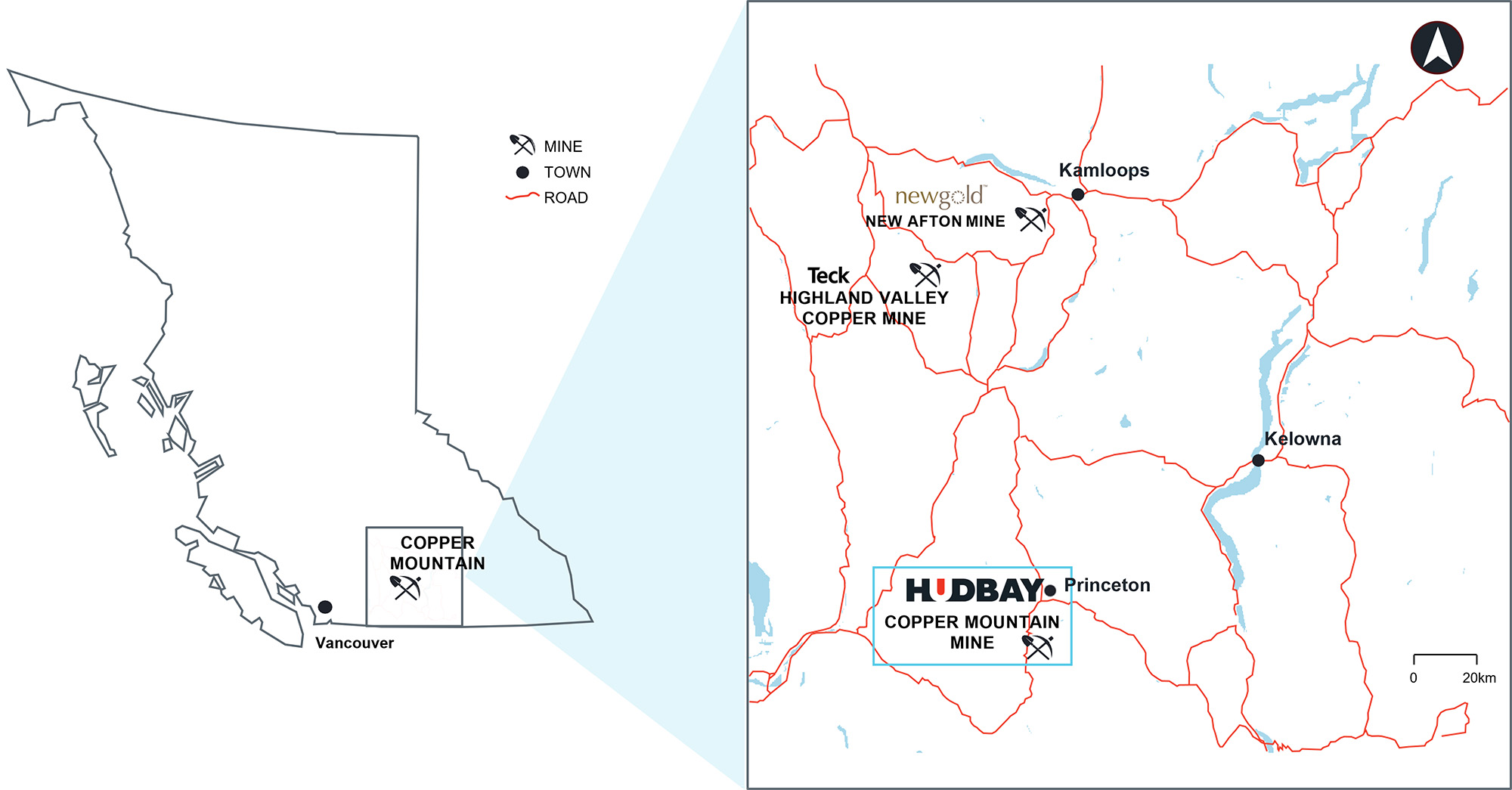

Copper Mountain mine in British Columbia

In 2023, Hudbay expanded its presence in Canada with the acquisition of the Copper Mountain mine in British Columbia. This pivotal move propelled Hudbay to become the third-largest copper producer in Canada. Hudbay owned 75% of the Copper Mountain mine, with the remainder owned by Mitsubishi Materials Corporation. In 2025, Hudbay entered into an agreement with Mitsubishi Materials Corporation to acquire their 25% interest in the Copper Mountain mine, consolidating Hudbay’s ownership to 100%.

Overview of Operations

Copper Mountain is located approximately 20 kilometres south of Princeton, British Columbia, in the Similkameen valley. This open-pit mining operation has a processing plant with a capacity of 45,000 tonnes per day. It employs conventional methods such as crushing, grinding, and flotation to recover copper concentrates, complemented by gold and silver by-products.

Hudbay released an updated technical report in December 2023 highlighting higher copper production levels and an improved cost outlook as compared to 2022 production as a result of implementing several operating improvements at the Copper Mountain mine. Utilizing a proven methodology for reserve and resource estimation, Hudbay is strategically positioned to optimize the Copper Mountain operations over the projected 21-year mine life, with opportunity for further future mine life extension.

- Conventional open pit copper mine

- 45,000 tonnes per day plant capacity

- Hudbay is implementing plans to stabilize the operation over the next few years to improve reliability and drive sustainable long-term value

- Long mine life with +20 years based on reserves

- Growth potential from New Ingerbelle expansion project

- First open pit mine in North American to install electric trolley assist haulage system to reduce emissions and improve efficiencies

Copper Mountain History

- Early 1900s: Initial early exploration

- 1923: Established the Copper Mountain mine as an operating mine, under the Allenby Copper Company

- 1925-1957: Formally owned and operated by Granby Consolidated Mining, Smelting and Power Company until 1957, primarily underground mining activities on the east side of Similkameen River. The ore was hauled by train from the Copper Mountain mine and processed at the nearby Allenby mill

- 1966-1968: Newmont Mines Canada Limited (Newmont) completed exploration programs at the Ingerbelle deposit, on the west side of the Similkameen River

- 1970-1972: Pre-production stripping of the Ingerbelle pit, and the construction of concentrator on the Ingerbelle side

- 1972-1981: Newmont mined the Ingerbelle open pit

- 1981-1996: Continued mining operation on the Copper Mountain mine and Ingerbelle sides of the property by Newmont, which changed to Princeton Mining Corporation in 1988. During this period, the former Allenby mill, associated structures, and disturbed areas were successfully reclaimed

- 1996: In 1996, the mine shutdown due to adverse market conditions. In 1998, Imperial Metals Corporation acquired the operation from Princeton Mining Corporation. Mine was in the care and maintenance phase until 2010

- 2006: Copper Mountain Mining Corporation (CMMC) acquired the mine and undertook major exploration and feasibility studies to expand the project

- 2009: Mitsubishi Materials Corp. and CMMC entered into definitive agreements. Mitsubishi acquired a 25% stake in the Copper Mountain mine

- 2010: CMMC completed construction of new infrastructure, including the current mill on the Copper Mountain mine

- 2011: CMMC owned and operated the Copper Mountain mine from 2011 to June 2023

- 2019: Entered into Participation Agreements with USIB in April 2019 and LSIB in July 2019

- 2023: Hudbay Minerals Inc. acquired the Copper Mountain mine

- 2025: Hudbay entered into an agreement with Mitsubishi Materials Corporation to acquire their 25% interest in the Copper Mountain mine, consolidating Hudbay's ownership to 100%

Updated Life-of-Mine Plan

- Average annual copper production of 46,500 tonnes over the first five years with an average of 45,000 tonnes for the next decade

- The updated mine plan represents an approximate 90% increase in average annual copper production and a 50% decrease in cash costs over the first 10 years compared to 2022 production levels

- The plan reflects Hudbay’s intentions to stabilize the operation by remobilizing idle haul trucks, opening additional mining faces and accelerating stripping over the next three years, optimizing ore feed to the plant and implementing plant improvement initiatives

- Mineral reserve estimates of 367 million tonnes at a copper grade of 0.25% and gold grade of 0.12 grams per tonne support a 21-year mine life

- Additional 140 million tonnes of measured and indicated resources at 0.21% copper and 0.10 grams per tonne gold and 370 million tonnes of inferred resources at 0.25% copper and 0.13 grams per tonne gold, exclusive of mineral reserves, provide significant upside potential for reserve conversion and extending mine life

For further information and to access the technical report please refer to Hudbay Disclosure Centre.

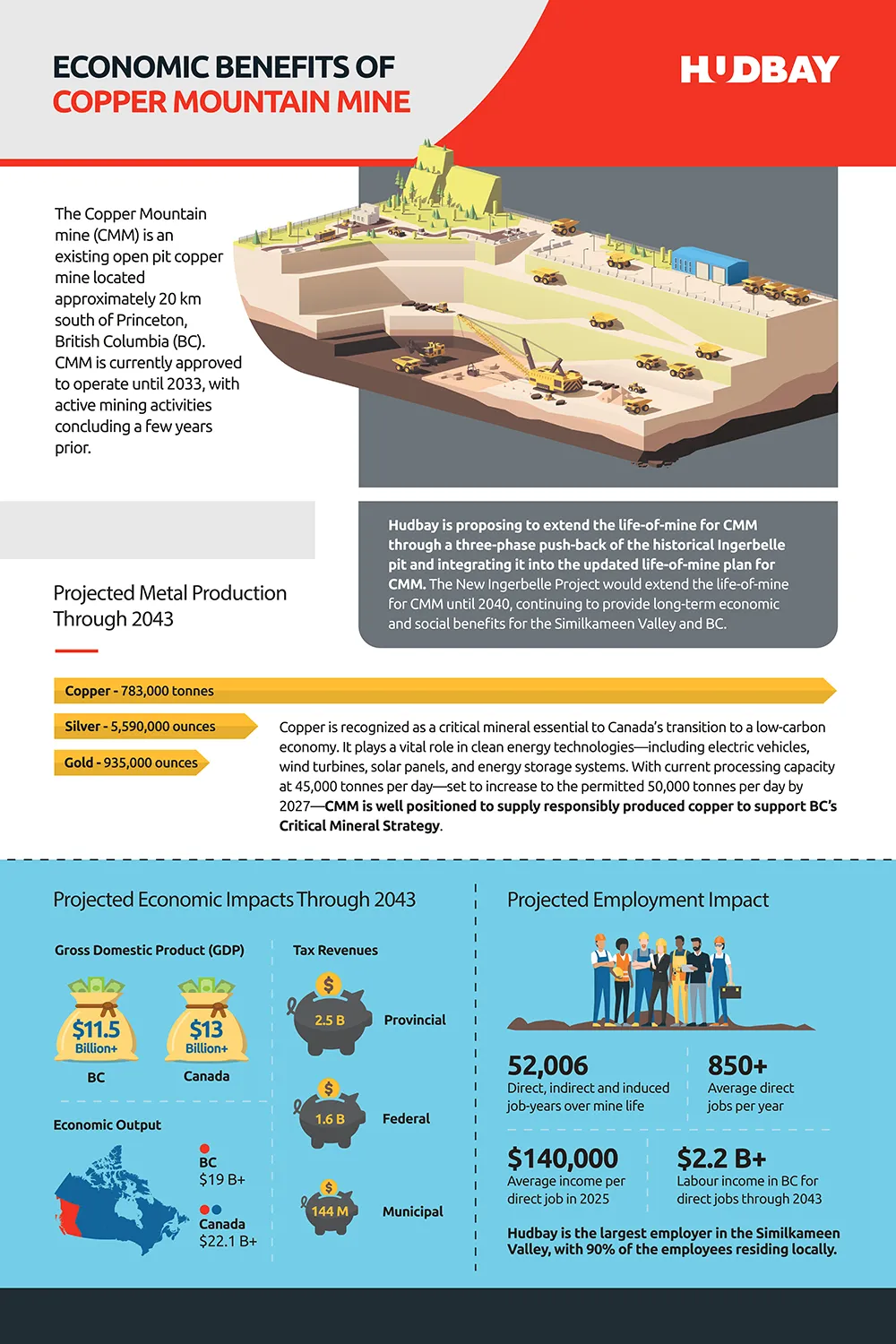

Projected Economic Impacts of Copper Mountain Mine Expansion

- Hudbay is seeking to extend Copper Mountain mine’s approved operating life-of-mine to 2040 by implementing a three-phase push-back of the historical Ingerbelle pit

- This proposed expansion will help sustain mining operations, preserve current jobs and continue delivering important economic benefits to the region and surrounding communities

- The New Ingerbelle Project is an extension of the existing Copper Mountain mine, focused on reactivation of the historic Ingerbelle pit — it is not a new or separate mine

Explore the full Economic Impact Study of the Copper Mountain Mine to learn more.